All business owners will eventually exit their business, and I believe it is important for leaders to prepare well to exit well.

There are a number of tactics that owners can implement that will help them prepare well for an exit and achieve a sale-ready posture. The beauty of adopting a sale-ready approach is that it has two powerful benefits. First, it will make the eventual exit of your business easier, faster, and more lucrative, whenever and however that exit event may come. Business owners in a sale-ready position have invested the time in laying the groundwork that will enable a thoughtful, smooth transition into a sale or other capital-raising process. It will also enable you to respond quickly if you unexpectedly receive an attractive unsolicited offer from a potential buyer.

Second, the process of preparing your business for sale will make your business better, today. Business owners with a sale-ready mind-set think more strategically, have better insights into their companies, and make better decisions on where to take their business next. They, therefore, create a two-fold benefit: when the time comes to exit, they have a more valuable business and are better prepared to exit.

“M&A professionals often talk about two types of buyers: strategic and financial, yet there are subcategories of each that are meaningful to understand as you think about what the ideal buyer for your business might look like.” – Jonathan Brabrand

A critically important component of sale-readiness is for business owners to fully understand the various options available to them, both in terms of buyer categories and specific companies within each. Depending on the seller’s desired outcome, their options may include domestic and international strategic (corporate) buyers, private equity and other types of financial buyers, or both. It also may include groups that will take a minority stake in your business, in addition to those groups who look to acquire controlling majority positions in companies.

It is only with a full understanding of the available options that sellers can make informed decisions about which buyers to contact in the first place, and ultimately, with which buyer they choose to transact. Otherwise, they risk looking back on the sale of their business with regret at stones left unturned.

Sometimes my clients equate exiting their business with “selling out” to their primary competitor, and in most situations, this is not a pleasant thought. This aversion to turning their enterprise over to a despised competitor, including the feelings of the disloyalty to employees it would create, leads many business owners to turn their back on the whole M&A process. If you have certain competitors or other companies that you would never want to acquire your business, no worries—you don’t have to include them in the process at all.

The truth of the matter is different; there are many types of buyers from which to choose, each with its own unique characteristics. Let’s take a quick look at the primary buyer classifications to get a better sense of who they are and what they have to offer.

M&A professionals often talk about two types of buyers: strategic and financial, yet there are subcategories of each that are meaningful to understand as you think about what the ideal buyer for your business might look like.

Strategic Buyers

Corporate acquirers, whether they operate in competitive or complementary lines of business, are termed strategic buyers, because their acquisitions are focused on targets that provide a strategic fit with their overall growth strategy. Strategic buyers always have a “Make versus Buy” decision. Would it be quicker and/or more cost-effective to acquire a given business or to invest in creating the same capabilities from scratch in-house?

Strategic buyers can offer many attractive advantages to a seller. Chief among them is the ability for the selling owner to retire from the business after a short transition period, typically three to six months. In addition, for business owners that desire a full exit through a sale of 100 percent of their ownership, strategic buyers are likely the best alternative.

The benefits to your business of selling to a strategic buyer can also be attractive. Access to the buyer’s larger base of customers, more robust sales team, broader distribution capabilities, or a better sourcing network can all have a significant positive impact on your business’s future. The primary downsides to strategic buyers are the potential loss of the business’s independent identity and the possibility of cost-cutting, such as elimination of back-office functions that can be handled by the buyer’s current staff.

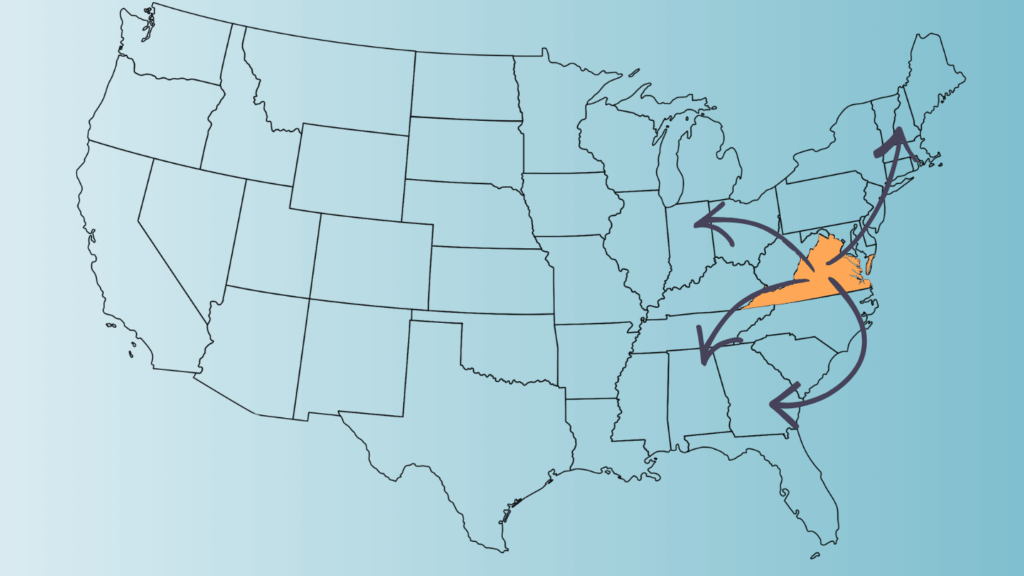

Strategic buyers can be further categorized by the location of their corporate headquarters. International strategic buyers often operate their US divisions independently with a hands-off approach, particularly if they don’t already have substantial operating businesses in the US. Domestic strategic buyers, on the other hand, are more likely to have higher levels of integration with their acquisition targets, yielding more efficient operations and cost savings that drive higher earnings to the bottom line.

Financial Buyers

Financial buyers are professional investors that acquire private companies with the goal of improving them before selling them several years later to realize a return on their investment. Hundreds of financial buyers are looking for small to medium-sized private businesses to acquire in the US, generally falling into one of three categories:

- Private Equity Groups

- Fundless Sponsors

- Family Offices

Private Equity Groups

Private equity groups are by far the largest cadre of financial buyers, both in terms of quantity and purchasing power. According to PitchBook, 563 new middle-market PE funds (funds of less than a billion dollars) were raised in the 2016–2018 timeframe, representing an aggregate of $148 billion of capital to invest in private companies.

The private equity model is simple and straightforward. A PE firm (the general partner, or GP) raises a pool of capital from investors (limited partners, or LPs) to then make equity investments in private companies. Private equity LPs often comprise insurance companies, pension funds, and college endowments that allocate a portion of their capital to private equity and other alternative investments, which offer higher returns with higher levels of risk.

Once a private equity fund raises the targeted amount of capital, the fund is closed to new LPs and the clock begins. PE funds typically have to invest all the committed capital in acquired businesses, called portfolio companies, within the first three to five years and then exit all the investments and fully return the capital to their investors within ten years. GPs earn an annual management fee, often 2 percent, of the total fund amount and then take a meaningful portion, often 20 percent, of the gains the fund generates. To increase the potential return on invested capital, PE firms will acquire businesses using a combination of their fund’s capital and bank debt that will be repaid by the portfolio company over time.

Because PE firms are professional investors and not business operators, they will control the Board of Directors, but rely completely on the existing management teams to run their portfolio companies. As a result, PE firms will motivate their management teams to increase the value of the business through options and the ability to own a minority portion of equity. The quality of management and their desire to remain in leadership positions are so important to most PE firms that they will not pursue acquisitions where management is not strong or wants to retire post-closing.

Fundless Sponsors

Fundless Sponsors are groups that pursue the same investment strategy as PE firms, but have not raised a fund of committed capital. Instead, they maintain a network of potential backers and raise the capital needed to make an acquisition on a deal-by-deal basis. For this reason, fundless sponsors are viewed as having more risk of a deal falling apart before closing than PE firms that control a fund of committed capital. That said, I have worked with a number of very successful fundless sponsors who were great partners to their portfolio companies.

Family Offices

Family offices make investments in private businesses like a private equity group, but their capital comes from one or more high-net-worth individuals or families. As such, they are considered more patient capital since they don’t have time pressure to sell their investments and return capital to LPs. In fact, many family offices take a long-term approach to their portfolio companies or may even plan to hold their businesses indefinitely. Family offices also typically use less bank debt in their acquisitions, which many business owners find more comforting.

PE-Backed Strategic Buyers

Once a private equity firm has made an investment in a stand-alone business, or platform company, they often seek to grow that platform by making smaller, add-on acquisitions. This PE-backed platform company thus becomes a hybrid category of buyer, blending the characteristics of both a strategic and financial buyer. It is common for platform companies to be particularly aggressive in pursuing add-on acquisitions in the first twelve to twenty-four months of PE ownership, when sufficient time exists to reap the rewards of the add-on growth strategy before the PE firm needs to sell the overall platform.

When you have a full understanding of the range of strategic and financial buyers that exist and what each can bring to the table in a potential transaction, you can make the best choice of partner for you and your business. For some sellers, a strategic buyer offers the ideal option for a successful exit. For others with a longer-term horizon and appetite to continue leading their company forward, private equity is the perfect partner.

Jonathan Brabrand is a Managing Director at Transact Capital Partners, a boutique M&A advisory firm and long-time corporate sponsor and supporter of the Virginia Council of CEOs.

Editor’s Note: This article was adopted from Jonathan Brabrand’s new book, The $100 Million Exit: Your Roadmap to the Ultimate Payday. If you would like to connect with Jonathan, you can reach him via email at jonathan@transactcapital.com or connect with him on LinkedIn.