Virginia CEOs Report Economic Outlook in 2013 2nd Quarter Survey

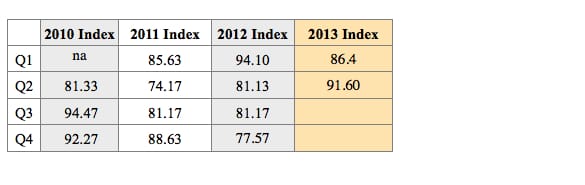

Robins School of Business –Virginia Council of CEOs survey finds CEO economic outlook index highest in four quarters. Staffing concerns are most on the minds of VA CEOs.

Each quarter the Virginia Council of CEOs (VACEOs) and University of Richmond’s Robins School of Business partner to take the pulse of top executives in the region.

The survey results provided by Jeff Pollack, assistant professor of management at the Robins School of Business, provide a snap shot of the overall economic outlook index for various companies within the region and help central Virginia companies anticipate business decisions and plan for growth. This quarter the survey finds the overall outlook index of top executives is the highest compared to the four previous quarters.

Says Scot McRoberts, executive director of the Virginia Council of CEOs, “I’m not surprised that the index is up. The CEOs I work with are busier than they have been in a while.”

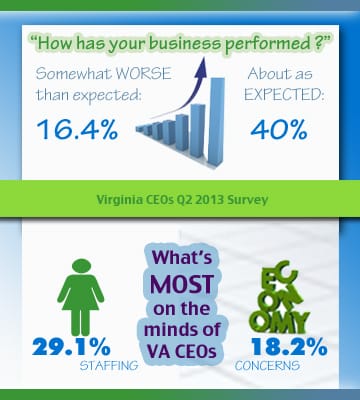

VA CEOs Economic Performance for 2nd Quarter, 2013

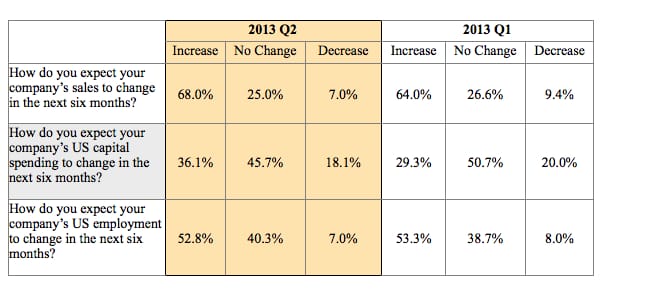

Among the executives of small and mid-sized companies participating in the survey, 68 percent anticipate an increase in sales, up 4 percent from last quarter. Expected capital spending has also increased 6.8 percent from last quarter to 36.1 percent. Employment expectancies decreased less than a point.

The survey also found staffing and economic uncertainty to be the most significant issues CEOs currently face. Some 40 percent of CEOs said their business performed about as expected over the past six months, with 9.1 percent saying performance was mostly better than expected, down 5.8 percent from the first quarter survey.

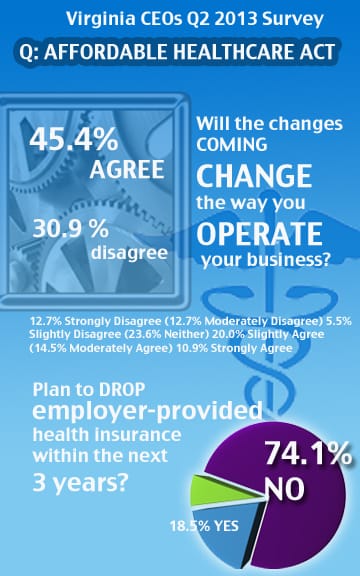

Affordable Care Act: Will VA CEOs Make Adjustments?

When asked “The changes coming to health insurance (Affordable Care Act) are changing the way you operate your business,” 23.6 percent said they neither agreed nor disagreed, while 20 percent said they slightly agree. Of the respondents 74.1 percent said they do not plan to drop employer-provided health insurance in the next three years. (First time question included in the Robins School of Business / VACEOs Economic Survey.)

“We see in these data a continued positive trend building from the last quarter—growing optimism regarding sales, capital spending, as well as employment growth for the next six months,” said Jeff Pollack, assistant professor of management at the Robins School, who calculated the results. “Staffing issues, economic uncertainty and rising healthcare costs are the top three areas of concern noted by the current sample of CEOs.”

Survey Results

The following survey results, from the first and second quarter of 2013 show projections for the next six months for sales, spending and employment:

The results also provide an overall economic outlook index, which is based on businesses’ projected six-month sales, spending and employment figures.

Economic Outlook Index

About the 2013, 1st Quarter Robins School of Business / VACEOs Economic Survey

The Quarterly Outlook Survey is conducted jointly by the Virginia Council of CEOs and University of Richmond’s Robins School of Business and is an adaption of the national Business Roundtable survey conducted by an association of CEOs of American companies.

This quarters results were based on the collected responses from 72 CEOs in central Virginia. The average annual revenue year-to-date for CEOs responding was $9.47 million. The data were compared to the first quarter 2013 of 75 participants. Multiple industries are represented in the sample (for example, construction, manufacturing, finance and insurance, and retail).

Request Results

The VA Council of CEOs continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

Leave a Reply