Virginia CEOs’ Economic Outlook Dims Slightly

Ninety-Six percent of CEOs identified either labor availability or inflation to be negatively impacting their business at this time with supply chain issues a distant third area of concern. That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

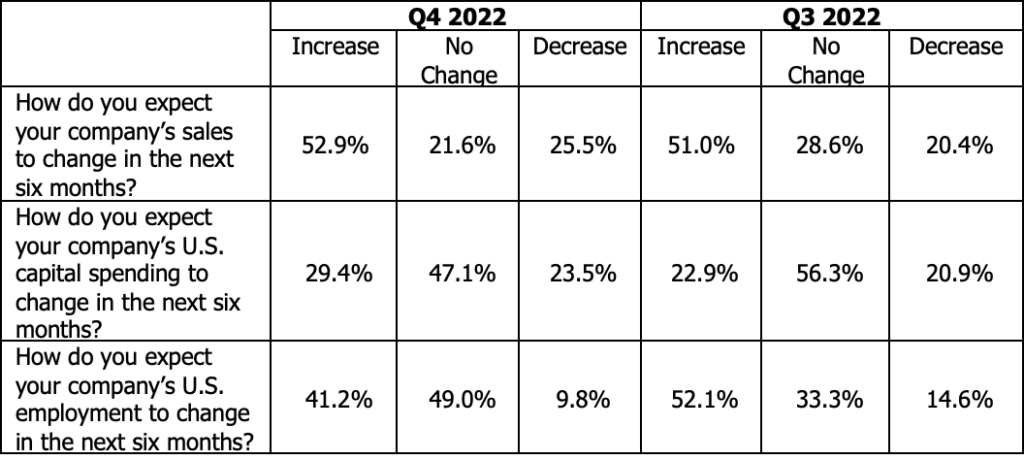

Fifty-three percent of CEOs expect sales to increase, with 25% expecting at least a 10% increase, while 41% expect employment to increase over the next six months.

The survey found expectations over the next six months for sales and employment were both somewhat positive although expectations were generally down compared with each of the last three quarters. Expectations with regard to capital spending remained primarily flat.

More than half (53%) of CEOs indicated that they expect sales to increase over the next six months.

- 6% expected sales to be “significantly higher.”

- 47% expected sales to be “higher.”

- 25% expected sales to be “lower.”

- 22% indicated they expected no change.

Twenty-nine percent of CEOs expect capital spending to increase over the next six months (up slightly from last quarter), while 24% expect capital spending to decrease. More than 47% expect capital spending to remain flat.

Forty-One percent of respondent CEOs expect employment to increase over the next six months. Additionally, 49% expect employment to remain flat while only 11% expect employment to fall.

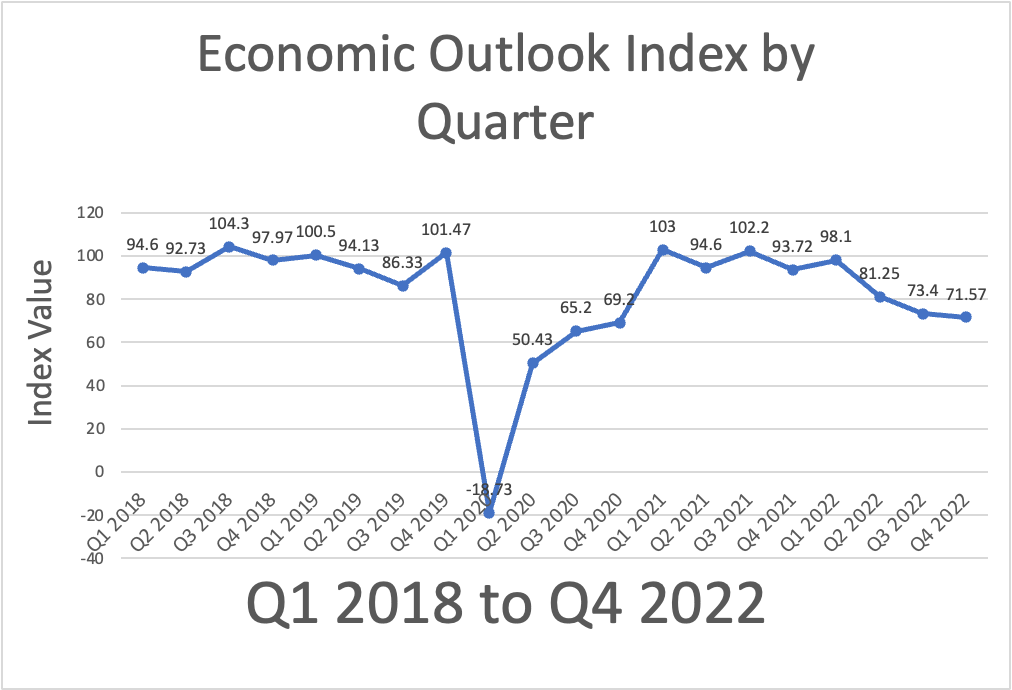

Taken as a whole, the results pertaining to sales, capital spending, and employment are less positive than the prior three quarters with the overall Economic Outlook Index decreasing somewhat (71.6 versus 73.4) relative to the results from the end of Q3 2022.

Additionally, CEOs were asked to rank order the degree to which labor availability, supply chain issues and inflation have negatively impacted their business. They reported the following:

- Labor availability had the most negative impact: 49%

- Inflation had the most negative impact: 47%

- Supply chain issues had the most negative impact: 4%

“The survey results suggest that CEOs see a bit of a leveling out of expectations in terms of growth over the next six months as well as ongoing concerns with regard to labor and inflation” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index is down slightly (71.6 versus 73.4 at the end of Q3 2022 and 93.7 a year ago).”

“Workforce challenges on top of inflation are keeping optimism down among our CEOs. That said, most of the business owners I talk with don’t foresee a hard recession, but a short, shallow slowdown forced by Fed policy” said Scot McRoberts, executive director of VACEOs.

Projected six-month sales, capital spending, and employment

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for sales, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Fifty-one CEOs responded to the survey, which was administered January 11 – 17. Multiple industries are represented in the sample although services and financial services represented the majority of the respondents. The average company whose CEO responded to this survey had about $12 million in revenue for the most recent 12-month period. The average employment was 44.

Leave a Reply