Virginia CEOs Concerned by Increasing Interest Rates and Bank Failures

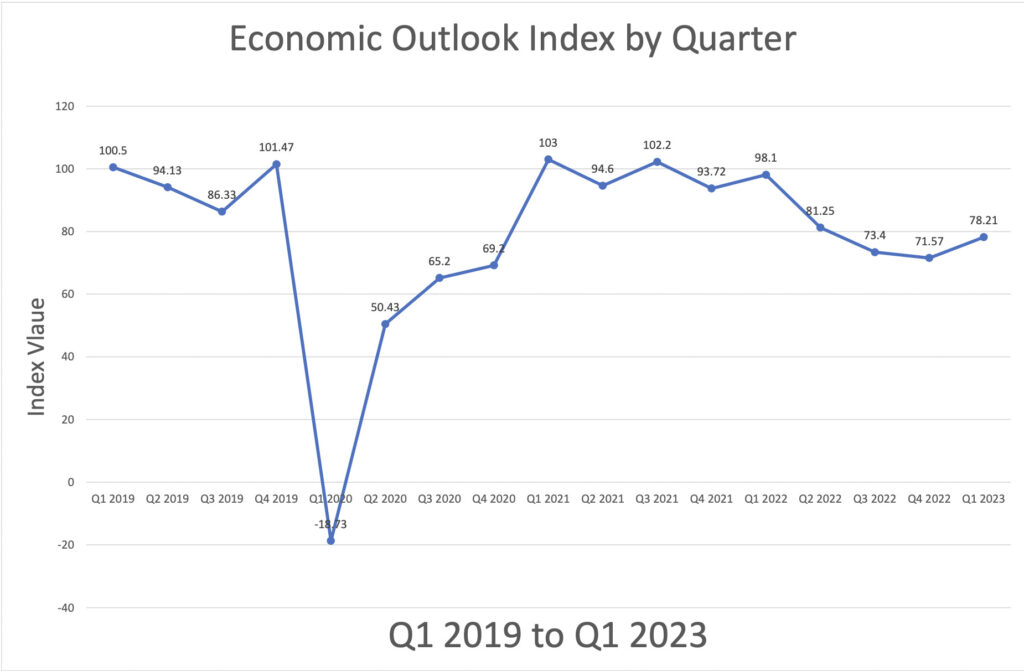

While interest rate increases and bank failures concern Virginia SMB CEOs, their economic outlook is rebounding for the first time since Q1 of 2022.

That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

- 49% of CEOs indicate that the rapid rise in interest rates has negatively impacted their business, while only 2% indicate that the interest rate increases have positively impacted their business.

- 31% of CEOs have at least considered changing their banking practices due to the recent bank failures.

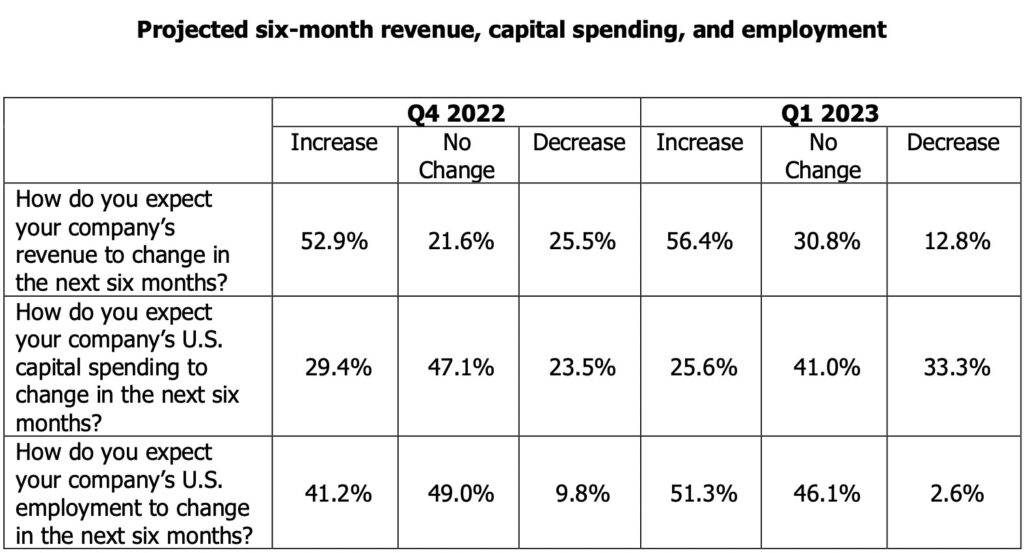

- 56% of CEOs expect revenue to increase with 30% expecting at least a 10% increase, while 51% expect employment to increase over the next six months.

The survey also found expectations over the next six months for revenue and employment were both positive and expected to grow faster than predictions from last quarter. Expectations with regard to capital spending remained primarily flat.

“The survey results suggest that CEOs see a more positive future than they have for the last 12 months. They have also felt a negative impact from the recent rise in interest rates,” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index is up for the first time in 12 months.”

More than half (56%) of CEOs indicated that they expect revenue to increase over the next six months.

- 5% expected revenue to be “significantly higher.”

- 51% expected revenue to be “higher.”

- 13% expected revenue to be “lower.”

- 31% indicated they expected no change.

About a quarter of CEOs (26%) expect capital spending to increase over the next six months (down slightly from last quarter), while 33% expect capital spending to decrease. More than 41% expect capital spending to remain flat.

Half of respondent CEOs (51%) expect employment to increase over the next six months. Additionally, 46% expect employment to remain flat while only 3% expect employment to fall.

Taken as a whole, the results pertaining to revenue, capital spending, and employment are more positive than any quarter since Q1 2022 with the overall Economic Outlook Index increasing (78.2 versus 71.6) relative to the results from the end of Q4 2022.

Additionally, CEOs were asked how the recent interest rate increases (from 0.25% to 5% over the last 12 months) have impacted their business. They reported:

- Little to no impact: 49%

- Negative impact: 49%

- Positive impact: 2%

They were also asked how the recent bank failures have impacted their banking practices. They reported the following:

- After evaluation, comfortable with current banking practices: 69%

- Have considered switching banks but have not: 23%

- Have made some major change to banking practices: 8%

“I think the continued optimism reflected in this survey represents the nimbleness of these small business CEOs. While most are concerned over higher interest rates, they have been able to adapt and continue to grow,” said Scot McRoberts, executive director of VACEOs.

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for revenue, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Thirty-Nine CEOs responded to the survey, which was administered April 4 – 11. Multiple industries are represented in the sample although services and financial services represented the majority of the respondents. The average company whose CEO responded to this survey had about $10 million in revenue for the most recent 12-month period. The average employment was 56.

Leave a Reply