November 2023 Quarterly Luncheon

Our final luncheon of the year featured a conversation with Bill Nash, CEO of CarMax. Incoming VACEOs Board Chair and CEO of TILT Creative + Production Ron Carey did a terrific job swapping stories and learning about how Bill’s leadership and CarMax’s entrepreneurial culture have led to such success.

VACEOs Member Profile: Philip O’Connor

Thanks to Phil O’Connor, Managing Partner of SPARK Product Development, for answering our many questions!

Q: Tell us about your first job after college, and your professional journey.

A: I attended Radford University and majored in Political Science. I had grand plans to attend law school and become an attorney; the universe had other plans. My first job out of college was working for Checkered Flag Motor Car Company in Virginia Beach selling MINI Coopers. It was a wildly important and impactful opportunity to learn about myself, sales and how to overcome objections.

From there, I worked for SunTrust Bank in Norfolk and then Hampton before making my eventual move to Richmond, starting a job in recruiting with Aerotek. It was at Aerotek where I found my passion in working with engineers in the manufacturing industry. It was fascinating to work with engineers from undergrad to my father’s age. The most interesting part of the job was getting to visit all the manufacturing facilities in Central Virginia and getting a true understanding of just how critical the industry is to the region. While I get excited to drive around industrial parks near airports and guess what’s being made in all the warehouses (Oreos and hummus for example), my wife prefers that we just keep moving and find the nearest parking space so we can make our flight.

Q: Who inspired you to become an entrepreneur?

A: Often during my professional career I would look at the entrepreneurs I worked with and ask myself, “Why can’t I do that?”

But if I really think about it, it’s my mother and father. While my father worked a steady career with Dominion, his example of working hard to achieve professional success and the ability to support a family stuck with me. My mother, on the other hand, was always hustling and doing her own thing. She started a business hosting craft classes at our house for other parents and their children. When my sister and I were a little older, probably middle school, she started “Christal’s Home and Garden” cleaning people’s homes and doing landscaping. Most of her clients were in the neighborhood and that meant she could be home when we got off the bus. Her next role was being a landlord for a few rentals she picked up in the neighborhood.

My wife, Sara, grew up in a home where her parents were small business owners. We definitely had a number of discussions when considering going this route and she was the most supportive in terms of making the leap.

Q: Tell us about your journey to becoming a CEO.

A: Maybe I was delusional, but I always thought I’d own a business. My younger self would tell you it was “O’Connor and Associates”; I made tri-fold sales pamphlets and business cards I hung on my childhood bedroom door. My client list was pretty exclusive, including all the famous actors and athletes of that time.

It’s not linear and certainly not without successes and failures. I’ve attempted any number of “jobs” over the years; some where I was an individual contributor and others where I managed a staff and was responsible for handling a Board of Directors. While at VCU, I moved from managing a portfolio of Corporate clients (philanthropy, sponsorship, student engagement and continuing education) to running one of the institutionally-related Foundations, the VCU College of Engineering Foundation. My wife Sara and I both worked at VCU during that time and we began to consider relocating, finding another engineering college to support and her working at a university hospital or in student health. The pandemic had other plans; we decided to stay in Richmond.

Having nurtured a network in Richmond mostly in the engineering, manufacturing and tech space, I looked around at several companies whose work intrigued me and placed a few strategic phone calls. The one I really wanted, SPARK Product Development, was a longshot. They were, and still are, a small business. Most of the staff was billable, a true consulting firm, with minimal overhead; adding me as Business Relationship Manager would change that. I started discussions with the owners, comparing notes on what “could be” and we finally came to an agreement at the end of 2020. We agreed to me being an employee for a year while we determined if it made sense to buy into the company and ultimately move into a leadership role to set the vision and strategy for the next generation of the business. Early 2022 I joined Bruce and Bill as the third owner and at the end of 2022 we transitioned the role of Managing Partner from Bruce to me.

Who is SPARK? What do we do? We’re a product design and development firm. We’re hired by other companies to come in and solve problems and develop new ideas – deliver solutions. We were part of the team who developed the Kobalt brand for Lowe’s and have several clients who have been with us for over 15+ years. We employ engineers and industrial designers and work mainly in the areas of consumer, medical and industrial products; the majority of our clients are mid-market and are B2B with their sales channels. That said, we’ve worked with a number of startups and inventors over the years and even support many of the research institutions here in Virginia. I’m honored to lead a 25+ year business with its roots in Henrico and I’m even more excited for the next 25 years.

Q: What to do read or listen to?

A: I have a number of them! As far as podcasts, some favorites of mine are The Pitch, How I Built This, Wisdom from the Top, Re:Thinking, Richmond Entrepreneur, That Will Never Work. I consume most of these as soon as they come out and share some of the ones I find most interesting or inspiring with friends and colleagues. Hearing these voices and their journeys in their personal and professional lives gives me time to consider what’s happening in my world and make thoughtful decisions. One of the more recent books I read was “The Ride of a Lifetime” by Bob Igor; can’t wait to see Volume 2 after getting back into the game. I just picked up Michael Lewis’ latest book, Going Infinite, which itself might be a cautionary tale of what not to do in leading a business.

Q: When you are not leading SPARK, what do you like to do?

A: We live in Church Hill in an old home from 1882. To know me is to know that our home is always under construction. We like to walk around the neighborhood and are suckers for a new Richmond restaurant (though my Alpha-Gal allergy puts a damper on the meats and cheeses).

Sara and I spend most weekends in Williamsburg. My folks still live in my childhood neighborhood and we enjoy sitting by the James River reading and just floating for hours in the water. The neighborhood is also just off of the Capital Trail and we can bike to a few places to eat or drink (if you do a century ride, look me up, maybe you can stop by to cool off). When it gets cold, there are plenty of fallen trees and branches that keep us warm by the bonfire.

During the F1 season you’ll find me watching qualifying sessions and waking up early to catch a race when it’s overseas.

Q: Tell us how you are involved in the community.

A: Education is central to the business and industry that I work in. Mentoring is also something near and dear to me after working with engineers for the majority of my career. I routinely mentor students at the VCU College of Engineering and help them with career exploration, resume reviews and interview preparation. Sara works at VCU Health and is a graduate of Brightpoint Community College’s Nursing program. We have supported a scholarship at Brightpoint and I also serve on the Brightpoint Community College Foundation Board. I’m Chair of the Institutional Advancement Committee and serve on the Executive Committee. Sara and I are also donors to the VMFA and support the Richmond Forum.

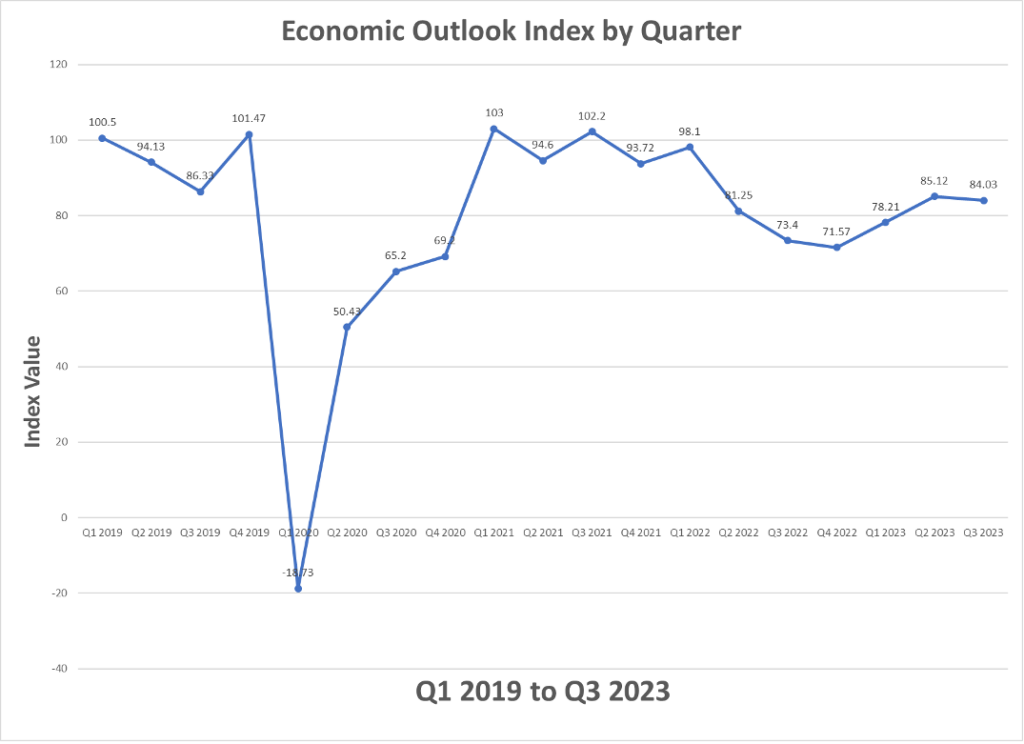

Virginia Economic Outlook Index Flat Versus Q2; Ninety-Eight Percent of CEOs Prefer the Fed to Hold or Reduce Interest Rates; Sixty-four percent Have Concerns About Inflation and Revenue

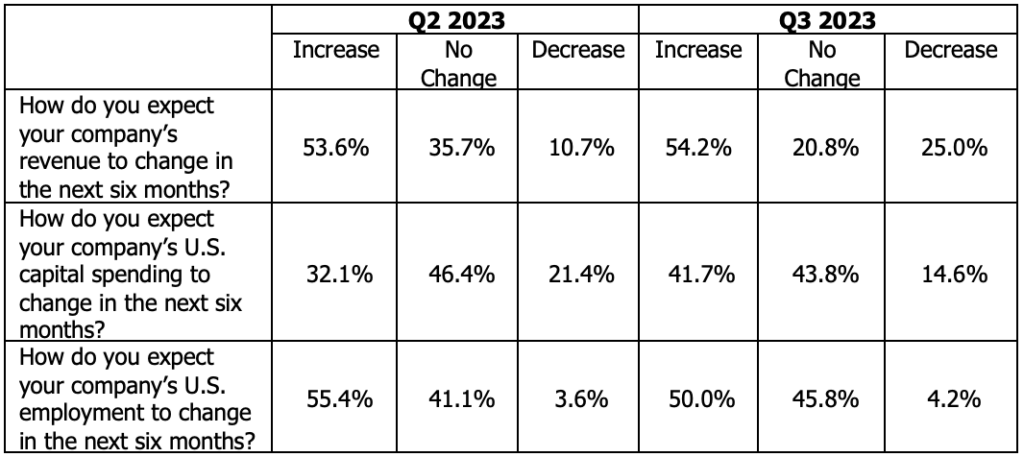

CEOs Again Expect Revenue and Employment to Increase Over Next 6 Months with Capital Spending Remaining Flat

Ninety-eight percent of small business CEOs indicate that they prefer that the Fed either reduce interest rates or hold them at the current rate with only 2% preferring that rates increase further. Sixty-four percent of respondents view inflation and revenue concerns as the biggest challenges facing their business in the near term versus 74% in a national survey by the U.S. Chamber of Commerce. That’s the latest from the quarterly CEO Economic Outlook Survey conducted by the University of Richmond’s Robins School of Business and the Virginia Council of CEOs.

Fifty-four percent of CEOs expect revenue to increase, with 23% expecting at least a 10% increase, while 50% expect employment to increase over the next six months.

The survey found expectations over the next six months for revenue and employment were both positive with capital spending to grow slightly faster than expectations a quarter ago.

More than half (54%) of CEOs indicated that they expect revenue to increase over the next six months.

- 4% expected revenue to be “significantly higher.”

- 50% expected revenue to be “higher.”

- 25% expected revenue to be “lower.”

- 21% indicated they expected no change.

Forty-two percent of CEOs expect capital spending to increase over the next six months (up slightly from 32% last quarter), while 15% expect capital spending to decrease. Forty-four percent expect capital spending to remain flat.

Fifty percent of respondent CEOs expect employment to increase over the next six months. Additionally, 46% expect employment to remain flat while only 4% expect employment to fall.

Taken as a whole, the results pertaining to revenue, capital spending, and employment expectations are down very slightly from last quarter with the overall Economic Outlook Index decreasing (84.0 versus 85.1) relative to the results from the end of Q2 2023.

Additionally, CEOs were asked their preference with regard to further interest rate changes by the Fed. They reported that they preferred the following:

- Further raise rates: 2%

- Reduce rates: 44%

- Leave rates as they are: 54%

They were also asked to rank order the challenges facing their businesses in the near term. They reported the following as the most challenging:

- Inflation: 32%

- Revenue Concerns: 32%

- Interest Rates: 23%

- Supply Chain Issues: 13%

“The survey results suggest that CEOs have positive revenue growth expectations but see inflation as an ongoing item of concern. They also strongly prefer that the Fed avoid further interest rate hikes” said Rich Boulger, associate dean at the Robins School, who administers the survey and collects the responses. “The overall index is approximately flat (84.0 versus 85.1 at the end of Q2 2023) and up from 73.4 of a year ago.”

“The sentiment from CEOs I am talking with lately is far more pessimistic than this data. The storm clouds they are seeing must be beyond the survey’s six-month outlook!” said Scot McRoberts, executive director of VACEOs.

The Robins School and VACEOs jointly conduct the quarterly survey, which regularly asks about expectations for revenue, capital spending, and employment, plus other relevant issues, helping Virginia companies anticipate business conditions and plan for growth. The Robins School adapted the survey from the Business Roundtable, an association of CEOs of American companies that conducts a similar survey nationally. Rich Boulger, associate dean at the Robins School, administers the survey and collects the responses. The quarterly survey has been administered since 2010.

Forty-eight CEOs responded to the survey, which was administered October 4 – 10. Multiple industries are represented in the sample although services and construction represented the majority of the respondents. The average company whose CEO responded to this survey had approximately $10 million in revenue for the most recent 12-month period. The average employment was 45.

The Council continues to expand the survey beyond its members, offering any area business owners whose companies gross at least $1 million in annual revenue the opportunity to participate. If enough businesses participate, the Council will provide survey results by industry. Participation is free, and all participants will receive copies of the survey data.

Business owners and CEOs who would like to participate in the next survey should contact Scot McRoberts at smcroberts@vaceos.org.

Virginia Council of CEOs (VACEOs) is a nonprofit organization connecting CEOs for learning and growth. Formed more than 20 years ago, member benefits include placement in a peer roundtable group and access to a thought leader network, and a robust program of events for learning and growth. This is not a networking group, but rather a group of CEO peers who are invested in the success of each Member. To qualify for membership CEOs must run a business with $1M+ revenue and 5+FTEs. Learn more at www.vaceos.org.

The Robins School of Business is the only fully-accredited, highly-ranked undergraduate business school that also is part of a highly-ranked liberal arts university. The Robins School is also home to the Richmond MBA. The school’s executive education division offers customized training and consulting to a wide variety of businesses.

Turning Insight into Action: Building Your Sales Playbook for 2024

It’s Fall. The temperature is dropping, leaves are changing, and there is a lot of uncertainty about the economy and politics, both logically and globally. No matter what your sales performance has been in 2023, one thing is for sure, you will be at a disadvantage if you don’t start to put together your sales playbook and growth plan for 2024.

What is a sales playbook?

A sales playbook is a resource that outlines your sales strategy, processes, and best practices. It provides your team members with relevant information about your growth goals, sales process, and sales activities/plays to execute during each stage of the selling cycle.

Why is a playbook important?

A sales playbook is vital to your company’s sales success in several ways, especially during uncertain times.

- Provides standardization, alignment, and scalability: Every member is more efficient, spends more time selling and less time searching for tools and answers, and is focused, consistent and effective executing your sales strategy.

- Supports launch of new products or services: Develop a standard play for your team to sell new products and to use existing processes and tools to build each new sales play.

- Use to hire and train: New hires usually have a lot to learn. Having a playbook in place will make it easier for them to get some foundational knowledge about your firm, and find answers themselves, reducing time spent searching and asking questions.

- Provides a better customer experience: Consistency across the organization in engaging, responding to, and answering customer questions is important to the customer experience. When a new best practice is developed, quickly scale it to support customers across the business.

- Reduces risk if you lose key sales leadership or personnel: When best practices are captured in the playbook, they can be reused across the team.

7 key elements of a great playbook:

Your sales playbook should be customized specifically for your company and team. It can be as detailed as you want but should include information necessary to execute your growth strategy. In general, a playbook should include:

- Company Overview: History, mission, value proposition, and goals.

- Products and Services Information: What exactly are you selling?

- Buyer Personas: Who are you selling each product or service to and in what channels?

- Sales Process Steps: Include all stages from finding leads, to qualification, to closing, and post-sale account management steps.

- Resources and Sales-Enablement Materials: CRM, templates, etc.

- KPIs and Metrics: Lead generation statistics, time to close, conversion percentage, etc.

- Commission Structure: What do your reps get if they go beyond their quotas?

What can you do to get started?

Whether you are a small company developing your first playbook or larger company updating your plays as you grow or diversify your product offerings, it is important to be prepared. Having a sales playbook that outlines your goals, plan, and plays ensures alignment across the organization and that your team will execute more consistently to thrive in 2024 regardless of broader market forces. The results of which support capabilities to sustain and further enhance growth in the long term.

The Author: Selena Sanderson, Managing Director Sales Advisory & Growth Practice Lead

If you would like to turn your insights into action and get started developing or enhancing your sales playbook, please join Fahrenheit Advisors and other VACEOs companies on November 1st to:

- Clarify your growth goals

- Develop sales plans, processes, and activities to achieve your objectives

- Install a system of measurement to keep your team on target

- Learn about other resources required to accomplish your plan

A cocktail hour will follow for an opportunity to network with fellow attendees.

Register for the Workshop: Building Your Sales Playbook for 2024 here.

Learn about Fahrenheit Advisors Sales Advisory Practice

Hyper Sales Growth with Jack Daly Recap

This September, the Virginia Council of CEOs held our annual Fall Leaders Conference led by world-class speaker and best-selling author Jack Daly. We had a great time learning from the very best in accelerating revenue and sales in a room filled with committed and driven business leaders and their teams. Save the date for next year’s Fall Leaders Conference on September 26 with the Marcus Sheridan!

Recent Comments