Do you take your fiscal year-end preparation in stride, or do you dread it? Whether your year end is December 31st, June 30th, or any other date, most likely you need to make sure your financial statements are ready for tax returns and, possibly, for auditors, bankers, and/or investors. The best way to take it all in stride is to ensure you take the proper steps monthly and quarterly for minimal work at the end of your fiscal year.

Here are the critical steps one should take throughout the year to ensure a smooth and painless fiscal year end.

MONTHLY:

- First and foremost, perform a good review each month of the balance sheet and profit & loss statement while information is still fresh in your mind.

- Run comparisons to budget and comparisons to prior year to identify variances that do not look right.

- Review all general ledger activity.

- Reconcile all the balance sheet accounts monthly, which will minimize year end corrections.

- On monthly bank reconciliations, ensure there are no checks over 60-90 days that have not cleared the bank. If there are, start calling vendors to see if they received check and re-issue as necessary.

- Run an Accounts Payable detailed listing and make sure all bills are current. Sometimes you have re-issued a payment for a lost check only to realize at year end that you haven’t taken care of the first payment that was lost or voided.

- Review Accounts Receivable aging and take follow-up actions accordingly.

- Record Investment activity monthly.

- Make copies of any capital purchases and consolidate in either a capital expense profit & loss account or in a category of fixed assets on your balance sheet.

QUARTERLY:

- Reconcile your wages paid to the 941 Employer’s tax form filed. This will ensure that all taxable wages paid have been reflected properly on the 941. If there are adjustments to be made, ensure you can correct before the annual W-2 Wage and Tax Statement are filed for employees.

- Ensure that board and committee minutes required for annual audits are approved and filed.

ANNUALLY:

- Make a reminder to review payroll adjustments necessary to be added to employees W-2’s for other taxable income.

- Review listing of 1099 eligible vendors and ensure you have proper federal identification numbers.

- If you are being audited by an outside firm, request a listing of documents needed in advance of field work.

- If you need an annual inventory count, schedule the date and publish procedures.

- Start a new filing system for the next fiscal year during the 2nd half of your last fiscal month, so that records can be kept separate right from the beginning.

- Review your fixed asset listing for any items that you have disposed of during the year.

** Above all, ensure that you reconcile your bank statement monthly. **

A key point is to take corrective action while transactions are still clear in your mind. It’s much harder to figure out adjustments if the details are fuzzy.

About Jill Swinger

About Jill Swinger

Jill Swinger is a director of Warren Whitney and is primarily engaged by organizations requiring financial management analysis. Jill offers a well-rounded business background and brings more than 30 years experience in both public accounting and private industry finance. Learn more.

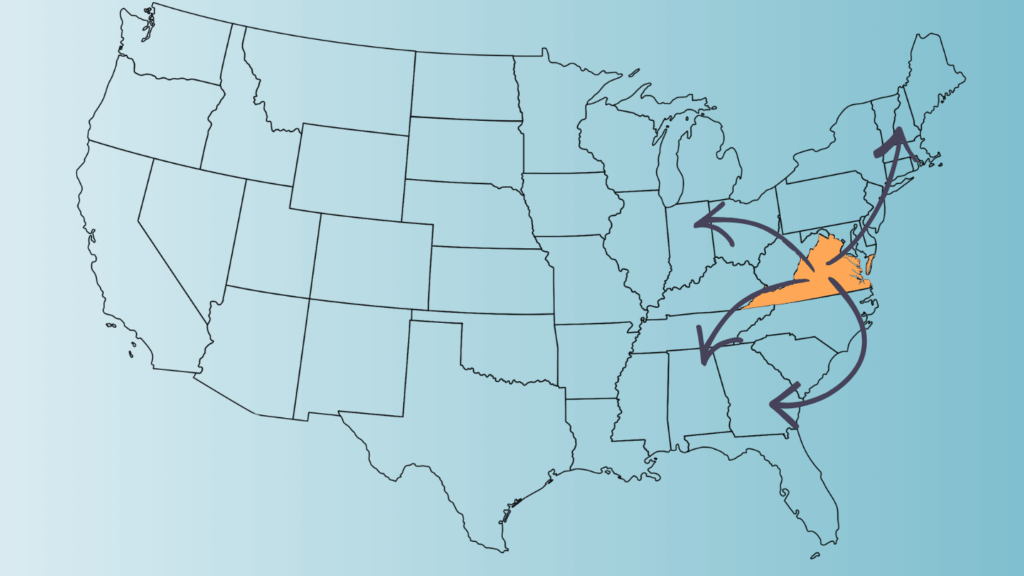

Editors note: Image and content provided by Warren Whitney. This post article was originally posted here. Warren Whitney is a Sponsor of Virginia Council of CEOs.