It seems easy. Your company sells a product or service for money, and that money needs to cover your expenses for you to be profitable. You know your income statement from top to bottom, and you can even forecast what the next few months, or years, will look like. What more could anyone ever ask of you? You submit all of your financial information to your banker, and you get to brag to them about how your business must be one of the must sought out in the banking community. Maybe the bank will even be open to an interest rate reduction on your loans!

It seems easy. Your company sells a product or service for money, and that money needs to cover your expenses for you to be profitable. You know your income statement from top to bottom, and you can even forecast what the next few months, or years, will look like. What more could anyone ever ask of you? You submit all of your financial information to your banker, and you get to brag to them about how your business must be one of the must sought out in the banking community. Maybe the bank will even be open to an interest rate reduction on your loans!

And then your banker asks: “Can you fill me in on why your liquidity position has taken such a big step backwards since last year?” The next question is even more puzzling: “You seem to be on board with leveraging the business more each year. When did that become a strategic plan for you?” And finally the statement: “I’m concerned about the duration of receivables and how it is really straining your ability to generate cash, especially with the amount of debt that you’ve taken on.” But, Mr. Banker, have you seen the net income of my business lately? Do you even pay attention to my revenue growth?

A balance sheet is a snapshot in time of three “categories” of your business including the assets, liabilities, and subsequent net worth. One of these categories is not impacted without the other being equally impacted, and they all must balance such that assets equal liabilities plus net worth. For instance (and very generally speaking), when you finance the purchase of a vehicle for your business, assets grow by the value of that vehicle. Debt will also grow due to the loan amount, so assets and liabilities have both increased. Most small business owners understand the importance of revenue growth and cost management to enhance profitability, but some are often stumped by, or even unaware of, their balance sheet.

So what are some things that your banker might be analyzing on your balance sheet? Below is just a small list of things that might be on their radar:

Liquidity

Liquidity is a measure of your company’s ability to cover its short-term debts by converting its short-term assets to cash. An example of an easily liquidated asset might be the collection of a receivable due from a customer for a service that you performed. It is most likely easier to collect the receivable than to sell a piece of equipment, vehicle, or land. Once collected, this receivable can then repay an obligation, such as an account payable, that is due within twelve months or less. Your banker is most likely paying close attention to your liquidity as it allows the bank to understand how quickly you can pay outstanding debts in the event of a downturn in operations and, of course, the bank’s financing. The easier it is to convert short-term assets to cash, the less risk of delayed payments towards debt granted by the bank.

Leverage

How much debt have you used to finance the assets of your business? This is what the bank calls leverage. Most bankers understand that companies have to take on debt in order to grow, but it is important that the amount of debt and payments towards loans do not strain cash flow to a point that operations are negatively impacted. Certain industries, such as those that need heavy machinery, will often require higher leverage, but the amount of debt in your business should not be causing a lack of growth due to strained cash flow. If your banker sees that you are too highly leveraged and the amount of debt obligations is hindering profitability and cash flow, you may not be a candidate for financing at that time.

Net Worth

Mathematically, net worth, or shareholders equity, is the value of your assets minus your corporate liabilities. If you show a positive net worth, you own more assets than debt which may allow you to “weather the storm” of an economic downturn by initiatives such as selling fixed assets to increase cash flow when revenues decline or collection of receivables slows. When your business is profitable and income is reinvested in the company rather than distributed fully to ownership, net worth will grow over time. If, however, liabilities exceed assets or losses are incurred that do not lead to net worth enhancements allowing for further investment in business assets, a bank will be challenged to extend even more debt. Very simply, if your business cannot handle a slowdown by converting its assets when cash flow is reduced, a bank may not want to lend to your company.

As you can see, these examples may coexist. If your company is illiquid, it may often mean that leverage is high and net worth is low. Or, if you are lowly leveraged, it is possible that you have strong current and long-term assets, limited debt, and a healthy net worth position. Remember, though, just because your income statement shows that you are “making money” does not necessarily mean that your company is as healthy as you think. Don’t forget to pay close attention to your assets, liabilities, and net worth, and have a conversation with your banker to further understand your balance sheet and how they view your ability to handle corporate debt.

About the Author

About the Author

Matt Paciocco is a Senior Vice President, Commercial Banker with Virginia Commonwealth Bank (VCB). Matt is passionate about working in a community bank that enables him to build strong relationships with his business customers and the surrounding communities. Matt has spent the last 15 years specializing in commercial banking and has positioned himself as a leading community banker in Richmond.

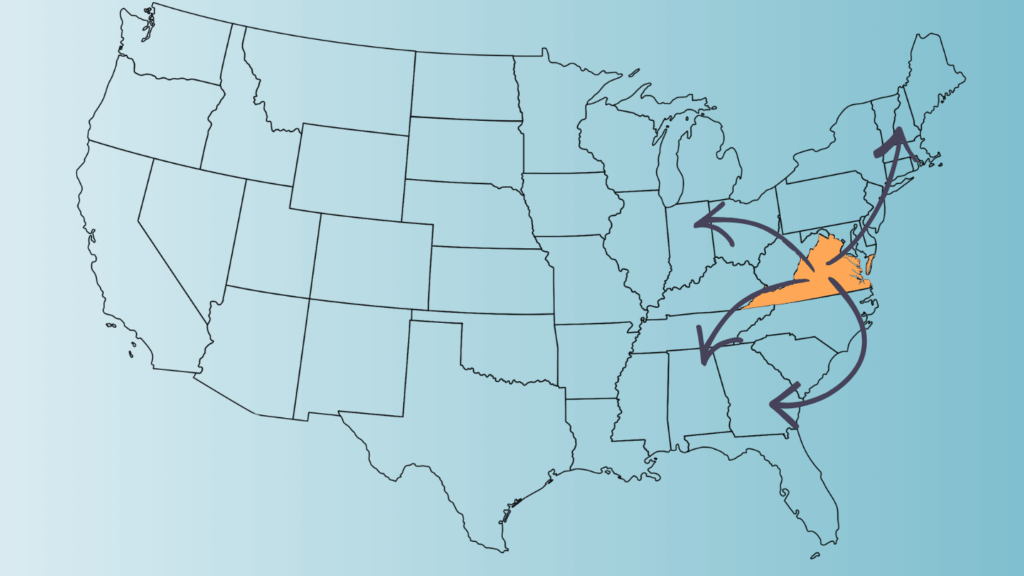

Editor’s note: Image and content provided by Virginia Commonwealth Bank (VCB). VCB is a Sponsor of VA Council of CEOs.